Two Bears

Two Bears

I haven’t seen any sensible descriptions of the bear argument for Apple, so I wrote it. ♻ ben-evans.com/benedictevans/…

— Benedict Evans (@BenedictEvans) April 22, 2013

In fact, Evans wrote two bear arguments.

Bear Argument #1

Bear Argument #1 is the imminent collapse of the iPhone in the face of significantly lower-cost alternatives:

As the industry moves on from converting featurephone buyers to fighting for replacement purchases, what happens to value? Growth for any given manufacturer necessarily becomes a matter of taking sales away from other smartphone manufacturers, not featurephone manufacturers (i.e. Nokia). Moreover, Moore’s Law is at work, driving down prices; you can now get a 4.5″ dual core Android phone from Huawei for just $200, and one from a generic Chinese manufacturer for $120-$150.

This is clearly a challenge for any handset OEM, but especially for one at the high end. There are fewer and fewer new high-end buyers coming into the market and the ones you sold to in the past may increasingly be tempted by ever improving cheaper phones. So a high-end phone maker risks losing sales if it stays at the high-end, or losing margin if it makes cheaper phones, or both.

In case it isn’t obvious, this is the essence of the bear story for Apple.

Bear Argument #2

Bear Argument #2 is the end of growth for the iPhone:

Smartphones sales may be approaching saturation (especially in the USA), but iPhone sales at the end of 2012 were just 10% of global phone sales – and 17% of global contract sales, which is more relevant since it reflects the subsidised market (of course, the possible decline of subsidies is another, rather separate bear story for any handset sold for over $200).

Is 17% the total potential market for a premium phone? Will market share only move from $600 phones to $300 phones, and never the other way? That might be the case if phones were fungible commodities, but they clearly aren’t – otherwise $600 Android phones wouldn’t sell at all. It is entirely possible that the premium phone market is here to stay, and that it could expand significantly.

In this case, the iPhone has saturated the high end, and while current iPhone users replace their iPhones, their overall numbers don’t increase significantly.

To my mind, this is the far more reasonable position. iPhone penetration seems to closely track carrier average revenue per user :

The largest remaining carrier without the iPhone – China Mobile – is solidly on the right side of that graph, along with most of the other high-growth countries. Apple may need to produce a lower-cost iPhone to compete, which will of course put significant pressure on their margins . It’s fair to ask if iPhone profit growth has peaked.

Only Bear Argument #2 Makes Sense

Bear Arguments #1 rests on the assumption that the iPhone is competing on hardware, and is therefore susceptible to lower-cost alternatives. However, the iPhone is not simply a device. Rather, it’s a ticket into an ecosystem (characterized here as the Mobile Hierarchy of Needs ):

This ecosystem is sticky, and users want to stay. According to the Yankee Group :

Of those surveyed, 91 percent of iPhone owners intend to buy another iPhone, while 6 percent plan to switch to an Android device with their next purchase. In other words, more than nine out of 10 iPhone owners are loyal to the platform. Once you buy an iPhone, chances are high you’re going to buy another.

That’s not quite as true for Android. Yankee found that 76 percent of Android owners intend to buy another Android phone. A big number, sure. But it means that 24 percent of Android phone users plan to switch to another platform. Guess where the majority of those professed switchers are going — 18 percent to iPhones.

Current iPhone customers aren’t going anywhere, even if Android continues to fall in price.

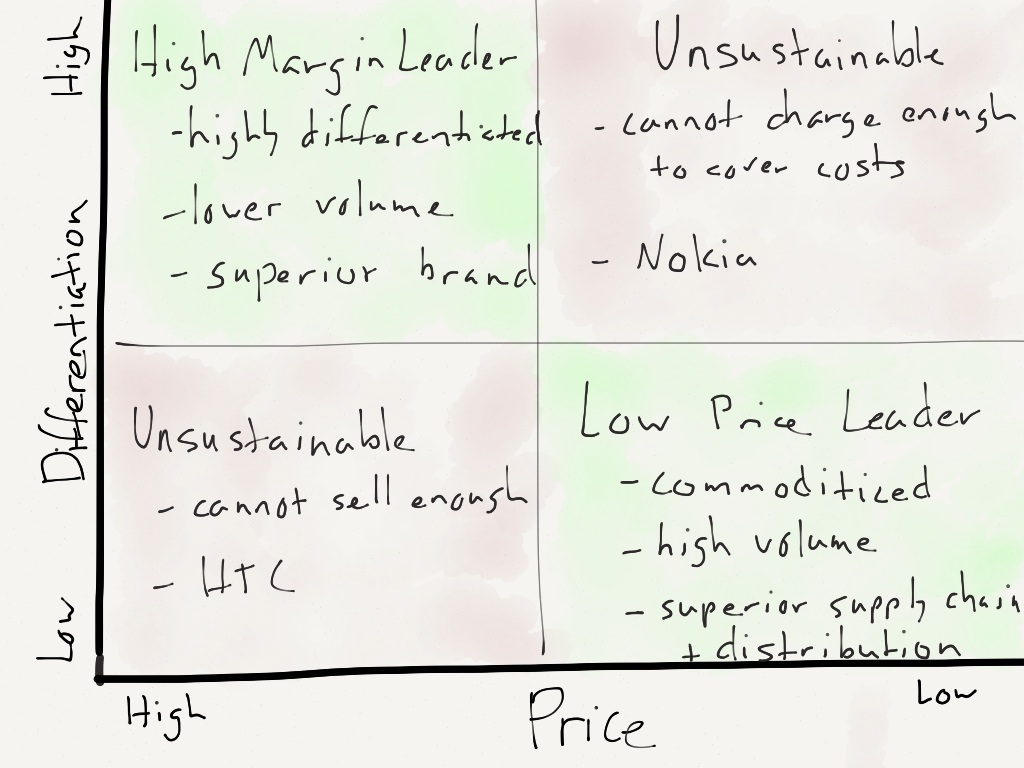

Almost all industries have two tenable positions: the differentiated high-end, and the low-cost low-end:

The iPhone faces little threat in the differentiated high-end of the market. Suggesting this market is limited in size is fair; counting the days until customers flee for cheap phones is silly. 1

The Bear Argument for Samsung

That’s not to say that Bear Argument #1 is invalid; in fact, it’s the Bear Argument for Samsung.

There is precious little that differentiates high-end Android from low-end Android. The second, third, and fourth layers 2 of the mobile hierarchy are identical; the difference is the hardware, and not only are low-end devices increasingly “good enough,” they’re also impossibly cheap.

I’ve written previously about MediaTek , the Taiwanese chipmaker that dominates this space, but Qualcomm wants a piece as well. From (always questionable) Digitimes :

Qualcomm and Spreadtrum Communications have both cut prices for their quad-core products to better compete against MediaTek, which controls half of the smartphone-chip market in China, according to industry sources.

Qualcomm recently quoted its quad-core solutions at less than US$10, slightly cheaper than MediaTek’s offerings, the sources indicated. Meanwhile, Spreadtrum has lowered its quad-core processor prices to similar levels. Both firms are trying to gain market share through aggressive pricing, the sources said.

Chinese OEM’s you’ve never heard of are making millions of smartphones using these chips. The largest of these is China Wireless. From Bloomberg :

China Wireless Technologies Ltd., the nation’s third-largest smartphone vendor, said it will eventually overtake market leaders Samsung Electronics Co. and Lenovo Group Ltd., helped by demand for low-cost phones.

A 50 percent surge in smartphone shipments will allow China Wireless to pass Lenovo for the No. 2 spot this year, while catching Samsung will take longer, Chief Financial Officer Jiang Chao said in a Bloomberg Television interview yesterday…

Total smartphone shipments in China will rise 44 percent to 300 million units this year, driven by handsets costing about 700 yuan ($113), researcher IDC forecast in December. Demand is surging as China Mobile Ltd., the world’s largest carrier by subscribers, aggressively encourages users of second-generation networks to upgrade to third-generation service with low- and middle-end smartphones. China Wireless, formed in 1993, has sold phones through China Mobile for a decade.

$10 chips, $113 dollar phones. No differentiation in software, apps, or services. Samsung actually sells most of their devices on the low end, but this low?

While the iPhone may have plateaued, it’s Samsung that should be worried about a cliff.

文章版权归原作者所有。