What Clayton Christensen Got Wrong

What Clayton Christensen Got Wrong

There’s no question Clayton Christensen , who developed the theory of disruption, is Silicon Valley’s favorite business school professor. For me, diving deep into his thinking in a corporate innovation class was a breath of fresh air from management theory that explained all of corporate America but for its most successful company – Apple.

It’s Apple, though, that has long been Christensen’s bugaboo:

- In a January 2006 interview with Businessweek, Christensen predicted the imminent demise of the iPod:

</br>Q: Can Apple keep it up?

Christensen: I don’t think so. Look at any industry — not just computers and MP3 players. You also see it in aircrafts and software, and medical devices, and over and over. During the early stages of an industry, when the functionality and reliability of a product isn’t yet adequate to meet customer’s needs, a proprietary solution is almost always the right solution — because it allows you to knit all the pieces together in an optimized way.

But once the technology matures and becomes good enough, industry standards emerge. That leads to the standardization of interfaces, which lets companies specialize on pieces of the overall system, and the product becomes modular. At that point, the competitive advantage of the early leader dissipates, and the ability to make money migrates to whoever controls the performance-defining subsystem.

- In a June 2007 interview , again with Businessweek, Christensen reiterated that the iPod was doomed, and further predicted that the iPhone would not be successful: 1

</br>The iPhone is a sustaining technology relative to Nokia. In other words, Apple is leaping ahead on the sustaining curve [by building a better phone]. But the prediction of the theory would be that Apple won’t succeed with the iPhone. They’ve launched an innovation that the existing players in the industry are heavily motivated to beat: It’s not [truly] disruptive. History speaks pretty loudly on that, that the probability of success is going to be limited.

- In a May 2012 episode of the Critical Path with Horace Dediu, Christensen again announced his pessimism about the iPhone. Forbes has a useful summary :

Christensen’s second concern is that although integrated approaches in technology can be quite successful for a period, in the end modular approaches to technology always defeat integrated approaches. Christensen said:

“The transition from proprietary architecture to open modular architecture just happens over and over again. It happened in the personal computer. Although it didn’t kill Apple’s computer business, it relegated Apple to the status of a minor player. The iPod is a proprietary integrated product, although that is becoming quite modular. You can download your music from Amazon as easily as you can from iTunes. You also see modularity organized around the Android operating system that is growing much faster than the iPhone. So I worry that modularity will do its work on Apple.”

It is this concern that is the primary bear narrative about Apple. But it’s wrong, because the theory of low-end disruption is fundamentally flawed. And Christensen is going to go 0 for 3.

Two Theories of Disruption

That final excerpt is useful in that it highlights the fact Christensen has two theories of disruption. 2

The original theory of disruption, now known as new market disruption, was detailed in Christensen’s seminal paper Disruptive Technologies: Catching the Wave and expanded on in the classic book The Innovator’s Dilemma . Based primarily on a detailed study of the disk drive industry, the theory of new market disruption describes how incumbent companies ignore new technologies that don’t serve the needs of their customers or fit within their existing business models. However, as the new technology, which excels on completely different attributes than the incumbent’s product, continues to mature, it eventually takes over the market.

This remains an incredibly elegant and powerful theory, and I fully subscribe to it. We are, in fact, seeing it in action with Windows – the incumbent – and the iPad and other tablets; new technology that is inferior on attributes that matter to Windows’ best customers, but superior on other attributes that matter to many others. (My belief in this theory is why I have been, to my own personal surprise, more sympathetic to Steve Ballmer – here and here – than most).

It is Christensen’s second theory of disruption – low-end disruption – that I believe is flawed. Christensen first described this theory in Disruption, Disintegration and the dissipation of differentiability 3 , and expanded on it in The Innovator’s Solution . It is this theory that is at the basis of Christensen’s critique of Apple quoted above.

Briefly, an integrated approach wins at the beginning of a new market, because it produces a superior product that customers are willing to pay for. However, as a product category matures, even modular products become “good enough” – customers may know that the integrated product has superior features or specs, but they aren’t willing to pay more, and thus the low-priced providers, who build a product from parts with prices ground down by competition, come to own the market. Christensen was sure this would happen with the iPod, and he – and his many adherents – are sure it will happen to the iPhone.

In other words, it’s not enough to say the iPhone has saturated the high end market and that growth will slow; rather, the iPhone will soon overshoot customers completely, and will in fact plummet in total sales in the face of good-enough Androids available for hundreds of dollars less than the overpriced iPhone 5C .

The Flaw in the Theory

Interestingly, Christensen himself laid out his theory’s primary flaw in the first quote excerpted above (from 2006):

You also see it in aircrafts and software, and medical devices, and over and over.

That is the problem: Consumers don’t buy aircraft, software, or medical devices. Businesses do.

Christensen’s theory is based on examples drawn from buying decisions made by businesses, not consumers. 4 The reason this matters is that the theory of low-end disruption presumes:

- Buyers are rational

- Every attribute that matters can be documented and measured

- Modular providers can become “good enough” on all the attributes that matter to the buyers

All three of the assumptions fail in the consumer market, and this, ultimately, is why Christensen’s theory fails as well. Let me take each one in turn:

Consumers Aren’t Rational

When I say “rational”, I’m referring to the Rational Choice Theory , which underpins traditional economic and business theory. Basically – and forgive my simplification – a rational buyer is one who consistently and accurately weighs benefits and costs and chooses accordingly.

In the case of low-end disruption, the rational buyer considers the superior integrated offering and the inferior (but still good) modular offering, decides the latter is “good enough,” and buys it because it is cheaper. The buyer knows the integrated offering is better, but the buyer is unwilling to pay a premium for features the buyer does not need.

The problem with rational choice theory can be stated in two ways. The first is to say that consumers are not rational. They have widely varying motivations, are susceptible to advertising, lack product knowledge, fall prey to the need for instant gratification, etc. I prefer to think that consumers are actually perfectly rational, but that our definition of rationality needs to dramatically expand beyond what is easily quantified.

Interestingly, though, business buyers are usually extremely rational. A CIO, for example, must justify a software purchase, and said justification usually comes down to balancing lists of features versus prices. Whatever solution scores best, wins. In other words, the first assumption underlying the theory of low-end disruption holds in the business-to-business market, but fails in the consumer market.

Every attribute that matters can not be documented and measured

The attribute most valued by consumers, assuming a product is at least in the general vicinity of a need, is ease-of-use. It’s not the only one – again, doing a job-that-needs-done is most important – but all things being equal, consumers prefer a superior user experience.

What is interesting about this attribute is that it is impossible to overshoot. I expanded on this in Apple and the Innovator’s Dilemma , an academic paper I wrote in 2010 that examined why the iPod wasn’t disrupted: 5

Apple’s focus on user experience as a differentiator has significant strategic implications as well, particularly in the context of the Innovator’s Dilemma: namely, it is impossible for a user experience to be too good. Competitors can only hope to match or surpass the original product when it comes to the user experience; the original product will never overshoot (has anyone turned to an “inferior” product because the better one was too enjoyable?). There is no better example than the original Macintosh, which maintained relevance only because of a superior user experience. It was only when Windows 95 was “good enough” that the Macintosh’s plummet began in earnest. This in some respects completely exempts Apple from the product trajectory trap, at least when it comes to their prime differentiation.

You see this time and again when it comes to iPhone differentiation, which focused on the actual experience, not numbers on a spec sheet:

- The iPhone has a superior touchscreen (which can only be felt, not bullet-pointed), but lower resolution than competing smartphones

- The iPhone has bigger pixels in its camera, but fewer of them relative to competing smartphones

- The iPhone has superior performance-per-watt, but fewer cores and lower clock speeds than competing smartphones

- The iPhone has superior battery life compared to a similarly-sized competing smartphone, or a much-smaller size compared to a competing smartphone with equivalent battery life

- The iPhone 5S’s biggest selling point is TouchID, technology that actually affects people’s day-to-day life

Listen again to Jony Ive’s introduction of the iPhone 5S and TouchID:

iPhone 5S is our most refined iPhone to date. It is meticulously designed, engineered and crafted, but it’s the remarkable innovation inside the iPhone 5S that sets a new precedent. It’s not just rampant technology for technology’s sake.

Every single component, every process, has been considered and measured to make sure that it’s truly useful and that it actually enhances the user’s experience.

This care, this consideration, extends to how we protect all of the important information that you carry with you on your iPhone. It’s what led us to create TouchID.

The business buyer, famously, does not care about the user experience. They are not the user, and so items that change how a product feels or that eliminate small annoyances simply don’t make it into their rational decision making process.

Again, though, Christensen’s research is tilted towards business buyers. Critically, this includes the PC. For the most of its history, the vast majority of PC purchasers have been businesses, who have bought PCs on speeds, feeds, and ultimately, price. Benedict Evans wrote a great piece last May called Apple, Open and Learning From History detailing this exact point:

In the 1990s, the PC market was mostly a corporate market (roughly 75% of volume). Corporate buyers wanted a commodity. They were buying 500 or 5000 boxes, they wanted them all the same and they wanted to be able to order 500 or 5000 more roughly the same next year. They wanted to compare 4 vendors on price with the same spec sheet. They didn’t care what they looked like (and they were going under a desk anyway) and they didn’t care how easy it was for non-technical people to set them up because the users would never touch the configuration. Nor did they care much about the user interface, because most of the users were only going to be running 1 or 2 apps anyway.

These are the buyers at the root of Christensen’s theory of low-end disruption, and they don’t care about what can’t be measured. They are not the buyers driving the smartphone market, who do.

Modular providers can not become “good enough” on all the attributes that matter to the buyers

The traditional business theory about vertical integration rests on the costs and controls. This article from QuickMBA describes it well (emphasis mine):

Two issues that should be considered when deciding to vertically integrate [are] cost and control. The cost aspect depends on the cost of market transactions between firms versus the cost of administering the same activities internally within a single firm. The second issue is the impact of asset control, which can impact barriers to entry and which can assure cooperation of key value-adding players.

The issue I have with this analysis of vertical integration – and this is exactly what I was taught at business school – is that the only considered costs are financial. But there are other, more difficult to quantify costs. Modularization incurs costs in the design and experience of using products that cannot be overcome, yet cannot be measured. Business buyers – and the analysts who study them – simply ignore them, but consumers don’t. Some consumers inherently know and value quality, look-and-feel, and attention to detail, and are willing to pay a premium that far exceeds the financial costs of being vertically integrated.

None of these types of consumers – and the attributes that appeal to them – fit into the theory of low-end disruption, nor were the sort of products that they buy included in Christensen’s research.

Counter-examples

With this critique in mind – that the theory of low-end disruption only applies to business-to-business markets – it’s worth examining counter-examples beyond Apple.

An obvious one in technology is consoles. Every successful console has been closed and integrated, thus providing a superior user experience. There has been no low-end disruption (although, interestingly, consoles are falling prey to new market disruption – again, I fully subscribe to that theory).

Another example is textiles – everything from shoes to clothing to accessories. According to low-end disruption, a bag is a bag is a bag. The credit card statement reflecting my wife’s birthday says otherwise!

Cars are particularly interesting because in Disruption, Disintegration and the Dissipation of Differentiability Christensen himself offered it up as a potential proving ground for his theory. While Christensen’s prediction was focused on a shift of profits from car makers to suppliers, it’s the sustainable differentiation between brands that Tim Cook highlighted in his own interview with Businessweek :

Q: Toyota makes a very nice car at many levels for a lot of people in the world.

TC: They do.

Q: But that’s different than a BMW.

TC: It is. It is, and the fortunate thing, though, is that we can provide a substantial number of customers a really great experience with really high-quality products. You said BMW, and I only speak up there because BMW’s share of the car market is a lot less than Apple’s share of the tablet market.

So we’ve found a way to make our products such that the experience is jaw-dropping. The quality and precision are just unbelievable, really. But we can do this for a lot of people. A whole lot of people.

Not all consumers value – or can afford – what Apple has to offer . A large majority, in fact. But the idea that Apple is going to start losing consumers because Android is “good enough” and cheaper to boot flies in the face of consumer behavior in every other market. Moreover, in absolute terms, the iPhone is significantly less expensive relative to a good-enough Android phone than BMW is to Toyota, or a high-end bag to one you’d find in a department store.

An Alternative Framework: Back to Porter

The framework that makes the most sense for the consumer market comes from another Harvard professor, Michael Porter.

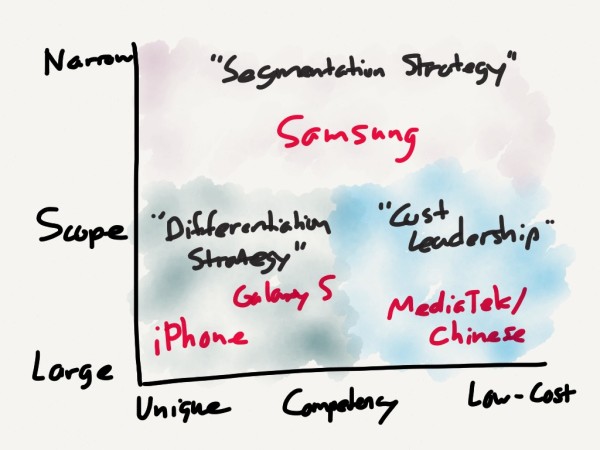

Michael Porter has described a category scheme consisting of three general types of strategies that are commonly used by businesses to achieve and maintain competitive advantage. These three generic strategies are defined along two dimensions: strategic scope and strategic strength. Strategic scope is a demand-side dimension and looks at the size and composition of the market you intend to target. Strategic strength is a supply-side dimension and looks at the strength or core competency of the firm. In particular he identified two competencies that he felt were most important: product differentiation and product cost (efficiency).

Low-cost is absolutely a viable strategy. The existence of Wal-Mart, Wrangler, and Kia attest to that. But differentiation is a sustainable strategy as well, and nothing about technology changes that. True, you can’t differentiate on technology alone, but Apple has been clear – explicit even – that their focus is on the sort of differentiation that matters to consumers. Listen again to the words of the commercial aired during WWDC :

This is it.

This is what matters.

The experience of a product.

How it will make someone feel.

Will it make life better?

Does it deserve to exist?

We spend a lot of time on a few great things, until every idea we touch enhances each life it touches.

You may rarely look at it, but you’ll always feel it.

This is our signature, and it means everything.

Apple is – and, for at least the last 15 years, has been – focused exactly on the blind spot in the theory of low-end disruption: differentiation based on design which, while it can’t be measured, can certainly be felt by consumers who are both buyers and users.

It’s time for the theory to change.

- Christensen later admitted he was wrong about the iPhone, noting that it wasn’t a phone at all; rather, it was disruptive to computing. I actually think this points to a missing piece in disruption theory, but that will have to wait for another essay. This is long enough [ ↩ ]

- Christensen’s first concern about Apple:

文章版权归原作者所有。