Selling Feelings

Selling Feelings

One of the more famous marketing frameworks is the Marketing Mix , also known as “The Four P’s.” According to the framework there are four key components to a marketing plan:

- P roduct (what is actually sold)

- P rice (how much the product is sold for)

- P romotion (how customers find out about the product)

- P lace (where the product can be found)

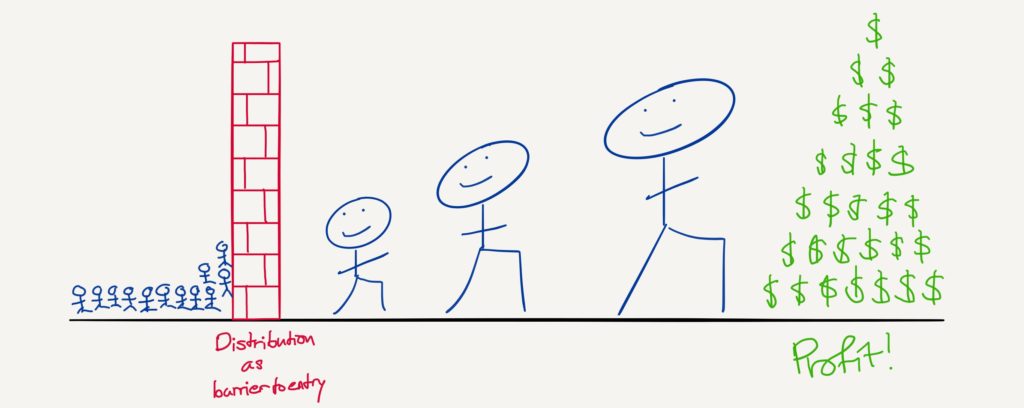

Of these four the most difficult and expensive — and thus, the greatest barrier to entry (i.e. the biggest moat) — was place. Actually getting your product in front of customers required relationships with wholesales and retailers, not to mention significant investments in logistics. Indeed, the companies who controlled distribution were often the most profitable of all.

Consider the media industry: broadcast networks had rights to the airwaves, cable networks needed to get carriage (which itself was offered by private companies, earning them tremendous profits), newspapers owned printing presses and delivery trucks, music companies printed albums and got them into stores, publishers did the same with books. From a business-model perspective all of these companies were similar: by controlling distribution they collected rents on what was actually distributed.

It’s not just media, though. Selling anything — clothes, shoes, pots and pans — depended on actually getting your product on the shelves, which meant dealing with wholesalers, retailers, shippers, etc., all of whom extracted their chunk of flesh. Your typical manufacturer would be lucky to get 40% of the retail price of an item, and often far less — and that is if said manufacturer could get their item in a store in the first place.

The Good Old Days

In short, starting a new business in any industry was really, really hard: simply getting your foot in the door required not just a great product but also a massive investment in getting that product in front of customers, and we haven’t even gotten to promotion (much less a price that pays for it all).

This ultimately benefited the largest players: Proctor & Gamble, for example, could leverage its relationships with retailers who already sold Tide laundry detergent and Pampers diapers to get shelf space for a new product line. Big department store chains could demand exclusivity for new apparel or drive down the price. Media companies could pick and choose who to feature, and on their terms. The payoff for actually getting a business off the ground was that once you made it things got a lot easier:

This is what the “good old days” looked like: pre-existing businesses at best competed with a known set of peer companies, or as was often the case, dominated individual markets, limited only by their ability to scale. Of course things weren’t so good for the folks who couldn’t manage to get distribution: at best they could throw their product over the wall and hope for whatever crumbs got tossed back for their trouble, while customers had to settle for products that tended to serve the lowest common denominator.

The Connection Between Price and Place

This context is why I tend to roll my eyes at, for example, complaints about the 30% commission charged by app stores. It used to be that publishing a piece of software was only partially about creating said software: just as important, if not more, was getting said software onto shelves where customers could actually pick them up, and a publisher was lucky to keep 30% of the retail cost for the privilege.

App stores changed everything: now anyone with a developer account could publish an app on the exact same terms as anyone else; Apple and Google could afford to do that because the Internet made shelf space effectively infinite. The wall was gone!

The problem, as App Store developers have increasingly realized, is that the existence of that old distribution wall was directly tied to the existence of profits on the other side: when anyone can sell software — when the place is open to all — no one can make a profit, because the price goes to zero.

The Problem With Selling Apps

I’ve been a longstanding critic of Apple’s approach to the App Store, most recently in From Products to Platforms . Specifically, I think the App Store’s refusal to support trials makes it difficult for superior products to differentiate themselves and thus charge a higher price, and the absence of upgrade pricing and customer data makes it difficult to get more money from a developer’s existing user base.

Still, I’ve long been cognizant that even were Apple to change its policies developers would be rolling the proverbial rock uphill. Back in 2013 I noted in Open Source Apps :

What makes the software market so fascinating from an economic perspective is that the marginal cost of software is $0. After all, software is simply bits on a drive, replicated at the blink of an eye. Again, it doesn’t matter how much effort was needed to create said software; that’s a sunk cost. All that matters is how much it costs to make one more copy: $0.

The implication for apps is clear: any undifferentiated software product, such as your garden variety app, will inevitably be free. This is why the market for paid apps has largely evaporated. Over time substitutes have entered the market at ever lower prices, ultimately landing at their marginal cost of production: $0.

Still, that doesn’t mean it’s impossible to make money.

Differentiated Games

Note the key adjective there: “undifferentiated.” What does it mean to be differentiated? There’s no question it has something to do with that first ‘P’, product. A differentiated product is “better” in some way, but all too often putting your finger on exactly what is better is a frustrating exercise. It just “feels” better, or, to switch that around, it’s about how it makes you feel. I’ve written extensively about the importance of the user experience and this gets at the same point: delivering an experience is less about features than it is the entirety of the experience, including approachability, usability, and even things like status or fitting in.

Consider the one app category that continues to succeed wildly on the App Store: free-to-play games like Candy Crush or Clash of Clans. Critics complain that they are manipulative, extracting money from culpable players in exchange for a worthless digital good that delivers little more than a sense of accomplishment to the buyer — a shot of dopamine, basically. But, if I may put on my contrarian hat, so what? Is said shot of dopamine any different than that obtained by any number of other means, many of which cost money? If differentiation is more about how something makes you feel and less about features then why the special bias simply because one particular something happens to be created in software? And, I’d add, digital dopamine results in a far more equitable business model for the developer: the more a user plays the more money a developer earns.

An even more extreme example is free-to-win games that are increasingly popular on the PC (yes, it’s still a thing!). Chris Dixon wrote a must-read post entitled Lessons From the PC Video Game Industry that described this business model:

The PC gaming world has taken the freemium model to the extreme. In contrast to smartphone games like Candy Crush that are “free-to-play,” PC games like Dota 2 are “free-to-win.” You can’t spend money to get better at the game — that would be seen as corrupting the spirit of fair competition. (PC gamers, like South Park, generally view the smartphone gaming business model as cynical and manipulative). The things you can buy are mostly cosmetic, like new outfits for your characters or new background soundtracks. League of Legends (the most popular PC game not on Steam) is estimated to have made over $1B last year selling these kinds of cosmetic items.

I know many of you are rolling your eyes — selling digital clothes for a digital avatar, and to the tune of a billion dollars? How silly must you be? Well, how silly must you be to carry a $5,000 handbag with far less functionality than another a fraction of the price, or wear a $10,000 watch or $200 necktie? What about flying first class or staying in a five-star hotel — you can’t take either with you! It’s completely irrational.

Or, rather, it’s irrational if you only look at features. The entire point is how these purchases make you feel , and it’s that feeling, whether it be an appreciation for craftsmanship, status, or simply being pampered, that provides the sort of differentiation that makes all of these products profitable. One could argue that an insistence on limiting the calculation of value to items that are permanent, physical, and easily listed on a spreadsheet is the real irrationality.

Make Your Market

In the case of those PC games, what the developers have done is actually exceptionally impressive, and something that should serve as a model for all sorts of businesses. Instead of trying to make money in a market — paid PC games — where making money is all but impossible thanks to the competition unleashed by the Internet, the developers effectively created an entirely new market — a virtual world filled with people lured in through free access and quality gameplay — and then leveraged their ownership of that market to fulfill the same sort of needs that fashion-focused businesses have been fulfilling forever. The need to look cool, or the need to stand out. The need to impress your friends, or simply to like how you look.

It doesn’t matter that it’s digital, by the way: any one person’s reality is ultimately wherever they choose to focus their attention and time, which makes games like League of Legends far more real to their inhabitants than the fashion boutiques in Paris would ever be — and far more exclusive. After all, there is only one seller.

Plus, just as is the case with free-to-play games, the economics are all in alignment: creating the market is a fixed cost which means it has no impact on the marginal cost of one more player. Why not add the maximum number of players (by making it free) and then develop a different revenue stream that pays out continuously the longer a player plays the game, ensuring the developer captures value as it is realized? Sure, said value may only be captured from some, and in relatively tiny increments, but remember we’re dealing with the Internet: you can make it up in volume.

Moreover, I think the model is broadly applicable. I wrote two weeks ago about how the future of publishing will not be about monetizing pure words but rather about using words to gain fans that can be monetized through other harder-to-discover media. Time and attention remain precious commodities and earning trust in one area gives you the right to make money from it in another. Similarly, as I wrote last week , software generally should be seen as a lever to solutions that are much more meaningful to customers, and much more difficult to copy. After all, as noted above, software is infinitely copyable: better to use that quality to your advantage than to base your business model on fighting gravity. 1

More broadly, the fact remains that business is difficult — it was difficult before the Internet, and it’s difficult now — but the nature of the difficulty has changed. Distribution used to be the hardest thing, but now that distribution is free the time and money saved must instead be invested in getting even closer to customers and more finely attuned to exactly why they are spending their money on you. Any sort of software — or writing, or music, or video, or clothing, or anything else — has never been purchased for its intrinsic value but rather because of what it did for the buyer — how it made them feel (informed, happy, relaxed, etc.). Create the conditions where the need might manifest itself and then meet that need, and not only will your business succeed, it will, in all likelihood, succeed to an even greater extent than the physically-limited lowest common denominator winners from the “good old days.”

- Like me… [ ↩ ]

文章版权归原作者所有。