Apple’s Social Network

Apple’s Social Network

While the saying goes that “No news is good news,” in the case of Apple it turns out that “News about no news is bad news.” From Bloomberg :

Apple Inc. shares had their worst day since 2014 amid concerns that growth in its powerhouse product, the iPhone, is slowing. In the fiscal fourth quarter, Apple said iPhone unit sales barely grew from a year earlier, even though new flagship devices came out in the period. At the same time, Apple said it would stop providing unit sales for iPhones, iPads, and Macs in fiscal 2019, a step toward becoming more of a services business. While some pundits praised the move as a way to highlight a potent new business model, many analysts complained it was an attempt to hide the pain of a stagnant smartphone market.

Apple has long been an exception in the smartphone space when it comes to reporting unit sales, so deciding not to is not that out of the ordinary; Apple, though, has always positioned itself as the extraordinary alternative — the best — and that approach paid off for years with sales numbers that were worth bragging about.

A History of iPhone Unit and Revenue Growth

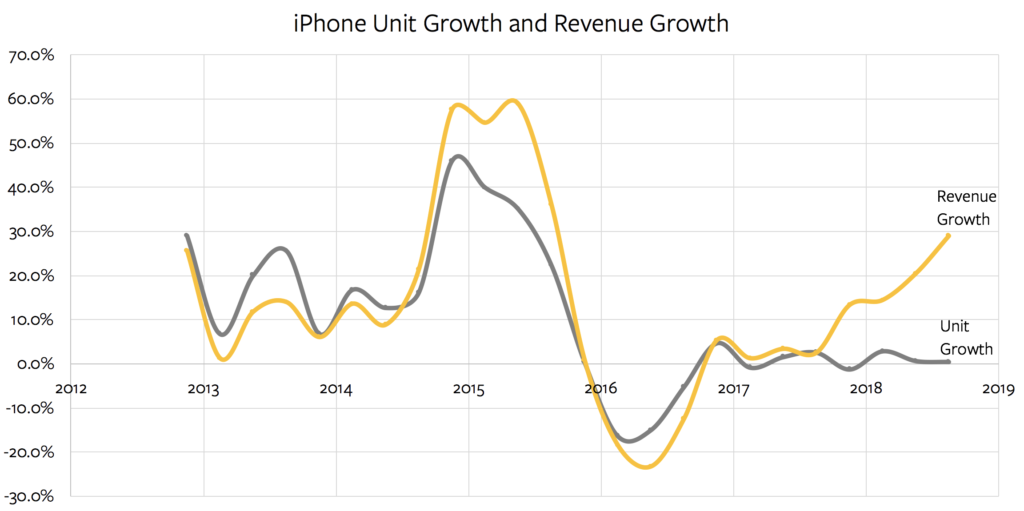

The reality, though, is that unit sales in isolation have indeed misrepresented Apple’s business for the last several years; specifically, they have underestimated it. Consider the last six years of iPhone revenue growth and unit growth:

iPhone unit growth and revenue were obviously highly correlated in the early years of the iPhone, when the only price difference in the line concerned the amount of storage on the flagship device. As Apple started keeping older models in the lineup, though, revenue growth was a bit slower than unit growth due to a slowly declining average selling price.

Then the iPhone 6 happened: not only was the “big-screen iPhone” stupendously popular — and, it should be noted, was the first phone sold at launch on all of China’s mobile carriers — it also, for the first time, included a configuration — the $749 iPhone 6 Plus — that had a higher base price than the iPhone’s traditional $649. The result was revenue growth that, for the first time, significantly outpaced unit growth.

The iPhone 6S was the opposite story: while Apple thought that iPhone 6 sales figures represented the new normal, in reality Apple had pulled forward a huge number of flagship phone buyers. Ultimately the company had to take a $2 billion inventory write-off on the iPhone 6S after over-forecasting sales; meanwhile, older model phones (including the iPhone 6) were still selling well, so again unit growth outpaced revenue growth.

It turned out, though, that the 6S was the new normal: iPhone unit sales have been basically flat ever since:

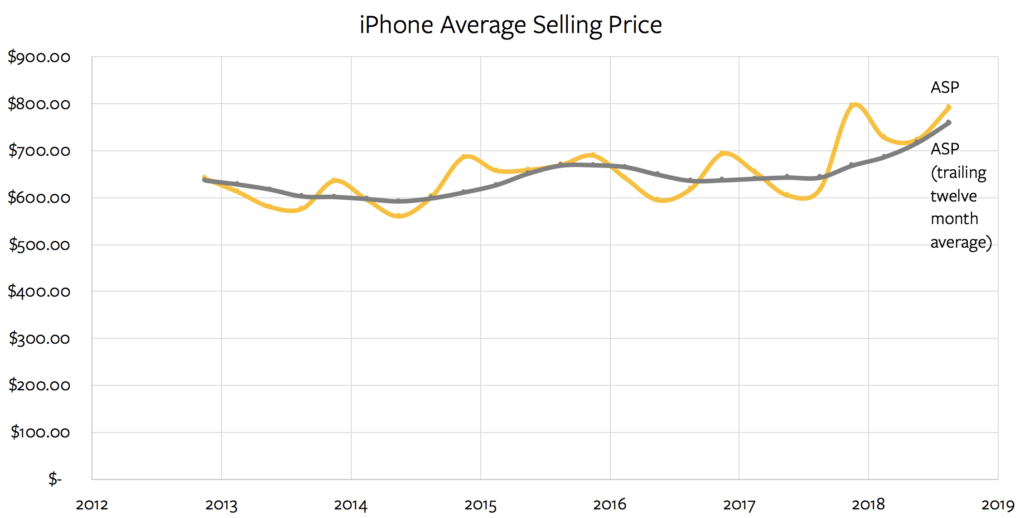

What has changed is Apple’s pricing: the iPhone 7 Plus cost $20 more than the iPhone 6S Plus. Then, last year, came the big jump: both the iPhones 8 and 8 Plus cost more than their predecessors ($50 and $30 respectively); more importantly, they were no longer the flagship. That appellation belonged to the $999 iPhone X, and given how many Apple fans will only buy the best , average selling price skyrocketed:

Still, even though unit growth had been stagnant for a full three years (not just the last year, as many reports, including the one above, incorrectly stated), reporting those numbers helped Apple tell its story: after all, you needed unit numbers to calculate the average selling price.

What the reports are right about, though, is that unit sales going forward are absolutely a story Apple would prefer to avoid: it is very unlikely that units will grow, and while Apple pushed pricing even higher with the iPhone XS Max, it probably can’t go much further, which means it is likely that the average selling price-based revenue growth story is drawing to an end as well.

Today at Apple

To this point I have focused on the iPhone, and for good reason: last quarter it made up 59% of Apple’s revenue; for the company’s holiday quarter it will likely approach 70%. However, the company will also stop reporting unit sales for Macs and iPads. This came on the heels of a product announcement last week where Apple introduced a new MacBook Air, Mac Mini, and iPads Pro; all were priced significantly higher than their predecessors.

This isn’t a surprise: the Mac line has been increasing in price for years, while the iPads Pro are balanced by a strong entry-level product that starts at $329. The reality of both the Mac and iPads Pro is that they are niche products, and niche customers are willing to pay higher prices for products that better meet their needs. 1

What was more interesting about last week’s event though, and which casts more light on Apple’s new growth story than the products announced, was the ten minutes in the middle devoted to Apple Retail.

This is how Apple CEO Tim Cook introduced the segment:

Now there are ways that Apple aims to inspire creativity in our users, including in our stores. The mission of our stores has always been to enrich the lives of our customers by educating and inspiring them to go even further. One of the new ways that we’re taking their creativity even further is through our Today at Apple sessions.

Today at Apple was announced with a press release in April, 2017, and received its first on-stage mention during the iPhone X keynote . Last week’s presentation, though, really highlighted how Today at Apple is perhaps the best way to understand the way Apple thinks about its growth opportunities going forward. Senior Vice President of Retail Angela Ahrendts explained:

We started with the things that are core to Apple’s DNA, things people most use their devices for and trust us to teach them, like photography, music, gaming, and app development. And as Apple continues to develop curriculum like Everyone Can Code and Everyone Can Create, we embed these lessons and techniques into our Today at Apple programming for all customers, including educators and entrepreneurs. And we hold all of our sessions in all 505 retail locations, like at Apple Cotai Central in Macau, which opened a few months ago. Here, customers are attending a session called Photo Walks, where they learn new features, like portrait lighting and depth control, while exploring the city together in a real social way…

And as we continue to push the design of our flagships to be even greater gathering places where everyone is welcome, we’re also creating global platforms for local talent. Photographers, musicians, developers, and artists share their creative gifts…

Since the launch of Today at Apple, only 18 months ago, we have held over 18,000 sessions a week, attended by millions of curious creatives around the world. And with the newest release of the Apple Store app, we’ve made it even easier for you to find out what’s happening near you. Just tap on the Sessions tab and you’ll see a spotlight of the newest Today at Apple sessions in your city. It will also recommend sessions based on the products that you own, and signature programs like Music Labs, Kids Hour, and Photo Walks.

What is striking about Today at Apple is the scale of its ambition combined with its price: free. Of course that is not true in practice, because one needs an Apple device to realistically participate (and an Apple ID to even sign up), but that raises the question as to what Apple customers are paying for when they buy an Apple product? Apple’s point in highlighting Today at Apple is that customers are not simply buying an iPhone or an iPad or a Mac, but rather buying into an ongoing relationship with Apple.

Apple’s Social Network

More broadly, this explains CFO Luca Maestri reasoning on the earnings call for no longer reporting unit sales:

Third, starting with the December quarter, we will no longer be providing unit sales data for iPhone, iPad and Mac. As we have stated many times, our objective is to make great products and services that enrich people’s lives, and to provide an unparalleled customer experience so that our users are highly satisfied, loyal and engaged.

“Engaged” is an interesting choice of words, as engagement is an objective normally associated with social networks like Facebook. The reasoning is obvious: the more engaged users are, the more they use a social network, which means the more ads they can be shown. Social networks accomplish this by aggregating content from suppliers as well as users themselves, and continually tweaking algorithms in an attempt to keep you swiping and tapping, and coming back to swipe and tap some more.

This is a world that has always been foreign to Apple: its past attempts at facilitating social interaction on its platforms are memorable only as the butt of jokes (iTunes Ping anyone?). This isn’t a surprise: Apple’s culture and approach to products are antithetical to the culture and approach necessary to create and grow a traditional social network. Apple wants total control and to release as perfect a product it can; a social network requires an iterative approach that is designed to deal with constant variability and edge cases.

This, though, is why Today at Apple is compelling, particular Ahrendts’ reference to bringing people together in a “real social way” — and she could not have emphasized the word “real” more strongly. Apple is in effect trying to build a social network in the real world, facilitated and controlled by Apple, and betting that customers will continue to pay to gain access.

Apple’s Average Revenue per User

To be perfectly clear, I am not arguing that Today at Apple is the answer to a saturated smartphone market or Apple reaching the limits of price increases. The company is clearly relying on “Services” revenue, which mostly means App Store revenue, a huge portion of which comes from in-app purchases for games, as well as a growing number of subscriptions, some provided by Apple (like Apple Music), but most by 3rd parties.

What this framing of a “real world social network” does provide, though, is insight into where it is Apple’s new reporting falls short. It is all well and good that Apple will now separate Services revenue and its associated cost-of-sales starting next quarter; more insight into Apple’s growth driver is clearly appropriate.

What is missing, though, is the equivalent of unit sales for Services, specifically, the number of active customers Apple has, and the associated revenue per user. This is the exact metric that matters to social media companies, and to the extent that Apple’s growth is derived from continually monetizing its existing user base over time, it makes sense here as well.

To be sure, an accurate number would very much include device revenue: I laid out in Apple’s Middle Age that the company’s growth was based on getting more money from its existing user base through higher average selling prices, selling more devices (i.e. Apple Watch, AirPods, HomePod, etc.), and increased services revenue; to the extent Apple is correct that focusing on only devices misses the story, it is also correct that focusing on only Services is misleading as well.

Apple’s Priorities

Unfortunately Cook already declared on another earnings call last February that this number isn’t coming:

We’re not releasing a user number, because we think that the proper way to look at it is to look at active devices. It’s also the one that is the most accurate for us to measure. And so that’s our thinking behind there.

There are two problems with this: first, while an active devices number is helpful, the 1.3 billion number that Apple announced on that February earnings call was the first in two years; it has not been updated since. Second, the number of active devices may be easier for Apple to measure, but it simply isn’t as valuable to investors as the number of active users for reasons Cook stated himself last week:

Our installed base is growing at double digits, and that’s probably a much more significant metric for us from an ecosystem point of view and customer loyalty, et cetera. The second thing is this is a little bit like if you go to the market and you push your cart up to the cashier and she says, or he says how many units you have in there? It doesn’t matter a lot how many units there are in there in terms of the overall value of what’s in the cart.

It’s not just “overall value”, though: it’s how many customers there are total, and the ways in which their cart is changing — i.e. what is the installed base, and what is the rate of growth that Cook is referring to?

Unfortunately Apple appears to be most concerned with the top and bottom line. Maestri said just before Cook’s comment:

At the end of the day, we make our decisions from a financial standpoint to try and optimize our revenue and our gross margin dollars, and that we think is the focus that is in the best interest of our investors.

It is certainly difficult for anyone, particularly Apple’s investors, to complain about Apple’s revenue and gross margin dollars, going on many years now. For all those years, though, said revenue and profit were based on unit sales.

Now Apple is arguing that unit sales is the wrong way to understand its business, but refuses to provide the numbers that underlie the story it wants to tell. It is very fair for investors to be skeptical: both as to whether Apple can ever really be valued independently from device sales, and also whether the company, for all its fine rhetoric and stage presentations, is truly prioritizing what drives the revenue and profit instead of revenue and profit themselves. I do think the answer is the former; I just wish Apple would show it with its reporting.

- Well, theoretically anyways, in the case of the MacBook Pro [ ↩ ]

文章版权归原作者所有。