The Value Chain Constraint

The Value Chain Constraint

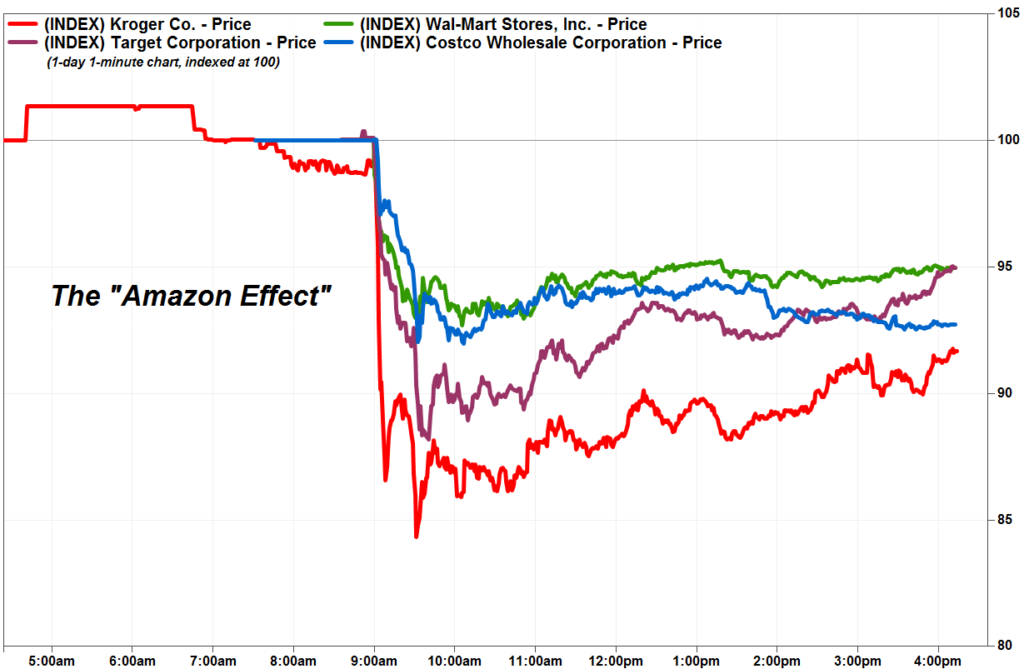

On June 16, 2017, minutes after Amazon announced it was buying Whole Foods Market Inc. for $13.7 billion, grocery store stocks fell through the floor; from MarketWatch ( emphasis mine ):

Shares of grocery stores took an unexpected hit Friday as investors reeled from the news that Amazon.com Inc. was moving into their space by acquiring Whole Foods Market Inc. After Amazon announced that it was buying Whole Foods in a $13.7 all-cash deal, shares of grocery store chain Kroger Co. slid to close down 9.2%, shares of Costco Wholesale Corp closed down 7.2%, Target Corp.’s stock closed down 5.2% and shares of Wal-Mart Stores Inc. closed down 4.6%…

Mark Hamrick, a senior economic analyst at Bankrate.com, said Amazon’s technological innovation in traditional retail is a “earthquake” for the sector, which it may have hinted at with its recent launches of brick-and-mortar Amazon bookstores. “ We can only imagine the technological innovation that Amazon will bring to the purchasing experience for the consumer ,” Hamrick said.

This is why I found Walmart’s recent earnings so interesting: the company cited groceries as the biggest drivers of its ecommerce business, both last year and going forward — the company plans to expand grocery pickup to an additional 1,000 stores — because, as Walmart CEO Doug McMillon put it on the company’s earnings call :

We strive to make every day easier for busy families as we increase convenience and save them money and time. Part of our strategy is to build on our existing strengths, such as having a broad assortment including fresh and perishable foods within 10 miles of 90% of the U.S. population.

Amazon, meanwhile, appears to be struggling; from Bloomberg :

The number of Amazon Prime members who shop for groceries at least once a month declined in 2018 compared with 2017, according to the results of an annual consumer survey released Wednesday by UBS analysts. The drop was surprising given the company’s Whole Foods investment and expansion of two hour delivery service Prime Now, the analysts wrote in a note to investors.

A separate study by research firm Brick Meets Click found that households using grocery delivery and pickup services from physical retailers spend about $200 per month and place orders more frequently than Amazon grocery shoppers, who spend $74 a month.

So where is the promised technological innovation?

The Conservation of Groceries

I have written several times about the Conservation of Attractive Profits , most notably with regards to Netflix , Facebook and BuzzFeed , and Zillow . To put it in generic terms, profit in a value chain flows to whatever company is able to successfully integrate different component pieces of that value chain; the other parts of the value chain then modularize and are driven into commodity competition.

For example, this is what Walmart’s traditional value chain looked like:

Walmart was able to integrate wholesale purchasing with an expansive network of stores; this provided a moat of sustainably lower prices for customer driven by purchasing power over suppliers.

Amazon, though, thanks to technological innovation — specifically, the Internet — was able to build a different integration in the value chain:

Amazon integrated wholesale purchasing and fulfillment centers with Amazon.com, relying on modularized delivery services for distribution; this provided a moat of superior selection and, at least at the beginning, lower prices, and with Prime, superior convenience, at least for non-perishable goods.

Walmart has worked for years to respond to Amazon’s threat; the problem, though, as I explained in 2016’s Walmart and the Multichannel Trap , is that an integration built around stores was fundamentally unsuited to offering the sort of selection and convenience that Amazon does. The company needed to build up an entirely new set of capabilities and integrations, even as Amazon was leveraging theirs to integrate forward into logistics, adding on a 3rd-party marketplace to expand selection even more, and integrating backwards into their own brands. The result is that Amazon has around 50% share in e-commerce while Walmart has less than 5%.

That, though, is precisely why groceries is worth examining: as I explained when Amazon bought Whole Foods , perishable goods are not well-suited to Amazon’s value chain. Superior selection has diminishing returns, quality varies on an item-by-item basis within a single SKU, and, most importantly, the quality of items degrades with time and transport. In other words, they are a great fit for stores, not distribution centers.

In this view, Amazon’s purchase of Whole Foods was an attempt to acquire a first best customer for its grocery delivery operation, one that would efficiently store and sell perishable goods that weren’t suitable for Amazon’s traditional e-commerce model. And, to be clear, this strategy may yet succeed, but only to the extent Amazon builds a completely new set of capabilities and integrations that will probably end up looking a lot like Walmart, which has a massive head start it is clearly taking advantage of.

In other words, what matters is not “technological innovation”; what matters is value chains and the point of integration on which a company’s sustainable differentiation is built; stray too far and even the most fearsome companies become also-rans.

Google Cloud Struggles

Consider Google, a company that, more than any other, has been predicated on “technological innovation”. This was possible because the company’s core product — Internet search — entered a value chain with no integrations whatsoever. On the supply side there were countless websites and even more individual web pages, increasing exponentially, and on the demand side were a similarly increasing number of Internet users looking for specific content.

Crucially, all of the supply was easily accessible — just link to it — and all of the demand was capturable — they only needed to type in google.com. This meant that the best search engine — and by best, I mean the purest form of the word, i.e. best performing — could win, and so it did. Google was leaps and bounds better than the competition, thanks to its focus on understanding links — the fabric of the web — instead of simply pages, and consumers flocked to it.

This set off the positive cycle I have described in Aggregation Theory : owning demand gave Google increasing power over supply, which came onto Google’s platform on the search engine’s terms, first by optimizing their web pages and later by delivery content directly to Google’s answer boxes, AMP program, etc., all of which increased demand, resulting in a virtuous cycle.

At the same time Google was building out two critical pieces of the value chain in integration with Search: the first was infrastructure — supporting that much demand required huge investments in servers, fiber optic cables, etc. — and the second was advertising. Ultimately the company’s model looked like this:

Note how Google is so dramatically optimized on all three sides of this integration: users, suppliers, and advertisers interact with Google through their own volition, thanks to the infrastructure Google has built to facilitate that interaction, with almost no person-to-person contact with anyone from Google. It is a model that works very, very well — for search and digital advertising, anyways.

Things have not gone so well for Google Cloud. At first glance, selling infrastructure seems like an obvious opportunity for Google, and much ink has been spilled about how the company — any day now! — will threaten Amazon or Microsoft. After all, Google was building out worldwide infrastructure before anyone else, and the company remains at the forefront of technological innovation.

The problem, though, is that the company’s value chain is completely wrong. The world of enterprise software is not a self-serve world (and to the extent it is, AWS dominates the space); what is necessary is an intermediary layer to interact with relatively centralized buyers with completely different expectations from consumers when it comes to product roadmap visibility, customer support, and pricing.

It has taken Google many years to learn this lesson: Google Cloud remains a distant third to AWS and Microsoft with a strategy that simply wasn’t working. I wrote in a November Daily Update upon the occasion of Google Cloud changing CEOs:

A strategy predicated on being “better” on specific product attributes, though, may fit the culture of Google, but it doesn’t necessarily lead to a winning enterprise strategy. To that end, Google Cloud faces three major problems:

- First, Google has not made an effective case about how specifically machine learning can benefit business that is appreciably different than traditional business analytics. That is not to say it can’t, just that the company hasn’t really made the case.

- Second, Google isn’t competing with Lycos and Yahoo: AWS and Microsoft have machine learning offerings of their own, and Microsoft in particular is much more accomplished at productizing offerings in a way that are understandable and approachable to CIOs.

- Third, and most importantly, the technical attributes of a product are only one piece of what matters to success in the enterprise. Just as important are customization, support, and the ability to sell. Google is widely regarded as being the worst in all three areas.

In short, what Google Cloud needs is not a CEO that fits the culture, because the culture of Google is about making the best product technologically and waiting for customers to line-up. That may have worked for Search and for VMWare, but it’s not going to work for Google Cloud. Instead the company needs to actually get out there and actually sell, develop the capability and willingness to tailor their offering to customers’ needs, be willing to build features simply because they move the needle with CIOs, and actually offer real support.

In short, Google Cloud is competing in a different value chain than is Google search, and it needs to build new integrations accordingly. To that end, note the strategy chosen by Thomas Kurian, Google Cloud’s new CEO; from the Wall Street Journal :

The new leader of Google’s cloud-computing business plans to dramatically expand its sales team, addressing one of the biggest challenges he faces as rivals Amazon.com Inc. and Microsoft Corp. race ahead in the market…While Google has long offered cloud technology, it has seen Amazon and Microsoft surge ahead to become the leaders in providing computing power and storage services for rent over the web. Those companies have robust sales and service staffs that large corporate customers demand to support their technology needs, an area where Google has trailed, analysts have said.

In other words, Google Cloud needs to look a lot more like Microsoft.

Microsoft’s Enterprise Value Chain

Microsoft, unlike Google, has always been first-and-foremost an enterprise company. That means its integration was between its operating system and the associated APIs on which enterprise apps were built:

Note, though, that unlike Google’s value chain, Microsoft is much further from the end-user: devices were built and sold by OEMs, sometimes to end users, but especially to enterprise IT departments by dedicated sales forces. Similarly, Microsoft developers were by-and-large enterprise software developers, working not for end users but for management.

This had obvious downsides in the consumer market: products in the Microsoft value chain were typically feature rich and user experience poor, exactly what you would expect from a world run by top-down purchase order, not individual consumer choice. To the extent Microsoft did succeed in the consumer space, the reason was a spillover from their dominance in enterprise; by the time pure consumer markets like the web or mobile came along, Microsoft was woefully unprepared to compete. They were basically the opposite of Google.

That, though, is also why Microsoft is succeeding with Azure even as Google struggles with Google Cloud: the company is used to value chains that include sales forces and top-down decision-making, and has the right business model and integrations to take advantage.

The Netflix Exception

Perhaps the most famous example of a prominent company “pivoting” and succeeding is Netflix, but that is very much the proverbial exception that proves the rule. Netflix built its initial customer base and IPO’d through a business model predicated on renting DVDs via mail. The value chain looked like this:

What was critical to making this value chain work was the first-sale doctrine : when a DVD was sold the rights of the copyright holder were exhausted; that means that Netflix could buy all of the DVDs it wanted and rent them to customers without copyright owners restricting them in any way. Critically, this meant that Netflix could integrate the customer relationship with content ownership.

Notice that that is the exact same integration that Netflix enjoys today: more and more of the company’s content catalog — particularly the portions that attract new customers — is original content owned by Netflix. In other words, the point of integration — the customer relationship and content ownership — is the same as in the DVD days.

To be sure, it took time for Netflix to transition to this model, and the company was absolutely helped along by hapless studio executives more interested in bumping up their annual profit than in considering their long-term position in the content value chain. There are any number of points in the early days of streaming when Netflix — because it was, if only temporarily, in a vulnerable non-integrated position in its value-chain — could have been stopped. I suspect, though, those days have past, which is why Netflix Flexes .

More generally, from a value chain perspective, Netflix’s transformation was less of a pivot than it might have first appeared: sure, the technology of DVDs by mail and streaming video are fundamentally different, but the value chain is the same. That is a far more viable transition than trying to leverage broadly similar technology into completely new markets and value chains.

The Solipsism Trap

It is understandable why the Internet giants in particular move into seemingly adjacent territories: the growth imperative is strong, both for financial and strategic reasons, and the technology seems easy enough, particularly given the resources these companies bring to bear. And yet, the truth is that those massive resources do not stem, at least in the long run, from technical excellence, but rather integration in specific value chains that produces positive feedback loops and outsize profits.

It follows, then, that without that integration, the positive feedback loops quickly disappear, along with the profits, which is the exact pattern we see again and again. Microsoft spent billions on phones and consumer Internet services, Amazon spent billions on Whole Foods, Google has spent billions on not just Google Cloud but a whole host of initiatives that have nothing to do with Search, Facebook has spent billions on Watch and VR, and now Apple is getting in the game with billions spent on Video, and the expected outcome of all these should be that they will fail.

To be sure, failure takes time: these companies do have nearly unlimited resources thanks to their core business models, and the reckless optimism bred by structural success. And, I suppose, sometimes they can actually push products across the line to profitability, kind of. Bing, for example is profitable — if you exclude traffic acquisition costs, which makes my point.

The reality is that technology has an amplification effect on business models: it has raised the Internet giants to unprecedented heights, and their positions in their relevant markets — or, more accurately, value chains — are nearly impregnable. At the same time, I suspect their ability to extend out horizontally into entirely different ways of doing business — new value chains — even if those businesses rely on similar technology, are more limited than they appear.

What does work are (1) forward and backwards integrations into the value chain and (2) acquisitions. This makes sense: further integrations simply absorb more of the value chain, while acquisitions acquire not simply technology but businesses that are built from the ground-up for different value chains. And, by extension, if society at large wants to limit just how large these companies can be, limiting these two strategies is the obvious place to start.

I wrote a follow-up to this article in this Daily Update .

文章版权归原作者所有。