Integration and Monopoly

Integration and Monopoly

When I started Stratechery in 2013, the conventional wisdom was that modularized ecosystems were best. After all, Microsoft had just spent the last thirty years dominating the tech industry by dominating the operating system layer and benefiting from competition everywhere else in the stack. Sure, the company’s dominance was slipping, but not because the model didn’t work: rather, the inevitable winner of the smartphone era would be Google, whose Android operating system was following the Windows playbook, with the rather attractive addition of being free.

That obviously didn’t happen: not only did Apple establish and maintain a sufficiently large install base to support an iOS ecosystem, the company went on to take the vast majority of profits in the entire smartphone industry; the exact share is uncertain, thanks to inconsistent reporting across the industry, but most estimates put Apple’s smartphone profit share between 70~90% for the last five years.

Apple, famously, is integrated, at least as far as the operating system and the hardware is concerned, and it turned out said integration was not only not a liability, it was actually a tremendous advantage.

The Benefits of Integration

I have written about Apple’s integration multiple times over the years, so rather than repeat myself allow me to highlight three advantages using three Articles.

First, integration provides for a superior user experience. From What Clayton Christensen Got Wrong :

The issue I have with this analysis of vertical integration — and this is exactly what I was taught at business school — is that the only considered costs are financial. But there are other, more difficult to quantify costs. Modularization incurs costs in the design and experience of using products that cannot be overcome, yet cannot be measured. Business buyers — and the analysts who study them — simply ignore them, but consumers don’t. Some consumers inherently know and value quality, look-and-feel, and attention to detail, and are willing to pay a premium that far exceeds the financial costs of being vertically integrated…

Not all consumers value — or can afford — what Apple has to offer. A large majority, in fact. But the idea that Apple is going to start losing consumers because Android is “good enough” and cheaper to boot flies in the face of consumer behavior in every other market…Apple is — and, for at least the last 15 years, has been — focused exactly on the blind spot in the theory of low-end disruption: differentiation based on design which, while it can’t be measured, can certainly be felt by consumers who are both buyers and users.

Second, integration maximizes the likelihood of success for new products — including the iPhone itself. From How Apple Creates Leverage, and the Future of Apple Pay :

The carriers [before the iPhone]…largely offered the same service: voice, SMS, and data, all of which was interoperable. This increased elasticity of substitution gave Apple an opportunity to pursue a divide-and-conquer strategy: they just needed one carrier.

Apple reportedly started iPhone negotiations with Verizon, but it turned out that Verizon was already kicking AT&T’s (then Cingular’s) butt through aggressive investment and technology choices, resulting in increasing subscriber numbers largely at AT&T’s expense. Verizon saw no need to change their strategy, which included strong branding and total control over the experience on phones on their network. AT&T, meanwhile, was on the opposite side of the coin: they were losing, and that in turn had a significant effect on their BATNA — they were a lot more willing to compromise when it came to branding and the user experience, and so the iPhone launched on AT&T to Apple’s specifications.

That is when Apple’s user experience advantage and corresponding customer loyalty took over: for the first time ever customers were willing to endure the hassle and expense of changing phone carriers just so they could have access to a specific device. Over the next several years Verizon began to bleed customers to AT&T even though their service levels were not only better, but actually widening the gap thanks to the iPhone’s impact on AT&T. Four years after launch the iPhone did finally arrive on Verizon with the same lack of carrier branding and control over the user experience; in other words, Verizon eventually accepted the exact same deal they rejected in 2006 because the loyalty of Apple customers gave them no choice…

Third, integration is incredibly profitable because it is, from a money-making perspective, a monopoly: Apple devices are the only ones that run iOS. From Everything as a Service :

Apple has arguably perfected the manufacturing model: most of the company’s corporate employees are employed in California in the design and marketing of iconic devices that are created in Chinese factories built and run to Apple’s exacting standards (including a substantial number of employees on site), and then transported all over the world to consumers eager for best-in-class smartphones, tablets, computers, and smartwatches.

What makes this model so effective — and so profitable — is that Apple has differentiated its otherwise commoditizable hardware with software. Software is a completely new type of good in that it is both infinitely differentiable yet infinitely copyable; this means that any piece of software is both completely unique yet has unlimited supply, leading to a theoretical price of $0. However, by combining the differentiable qualities of software with hardware that requires real assets and commodities to manufacture, Apple is able to charge an incredible premium for its products.

The results speak for themselves: this past “down” quarter saw Apple rake in $50.6 billion in revenue and $10.5 billion in profit. Over the last nine years the iPhone alone has generated $600 billion in revenue and nearly $250 billion in gross profit. It is probably the most valuable — the “best”, at least from a business perspective — manufactured product of all time.

Now, five years on, the conventional wisdom has flipped: integration is clearly the best. Just look at Apple! Indeed, looking at Apple, it is hard to escape that conclusion, but it is worth pointing out that the last week has highlighted a number of potential downsides.

The Keyboard Kerfuffle

Last week Apple did something that was shockingly momentous: it released a new laptop with what appears to be a user-friendly keyboard, both in terms of how it works and how often it works. I say shockingly because it is pretty incredible that such a should-be-mundane feature was momentous.

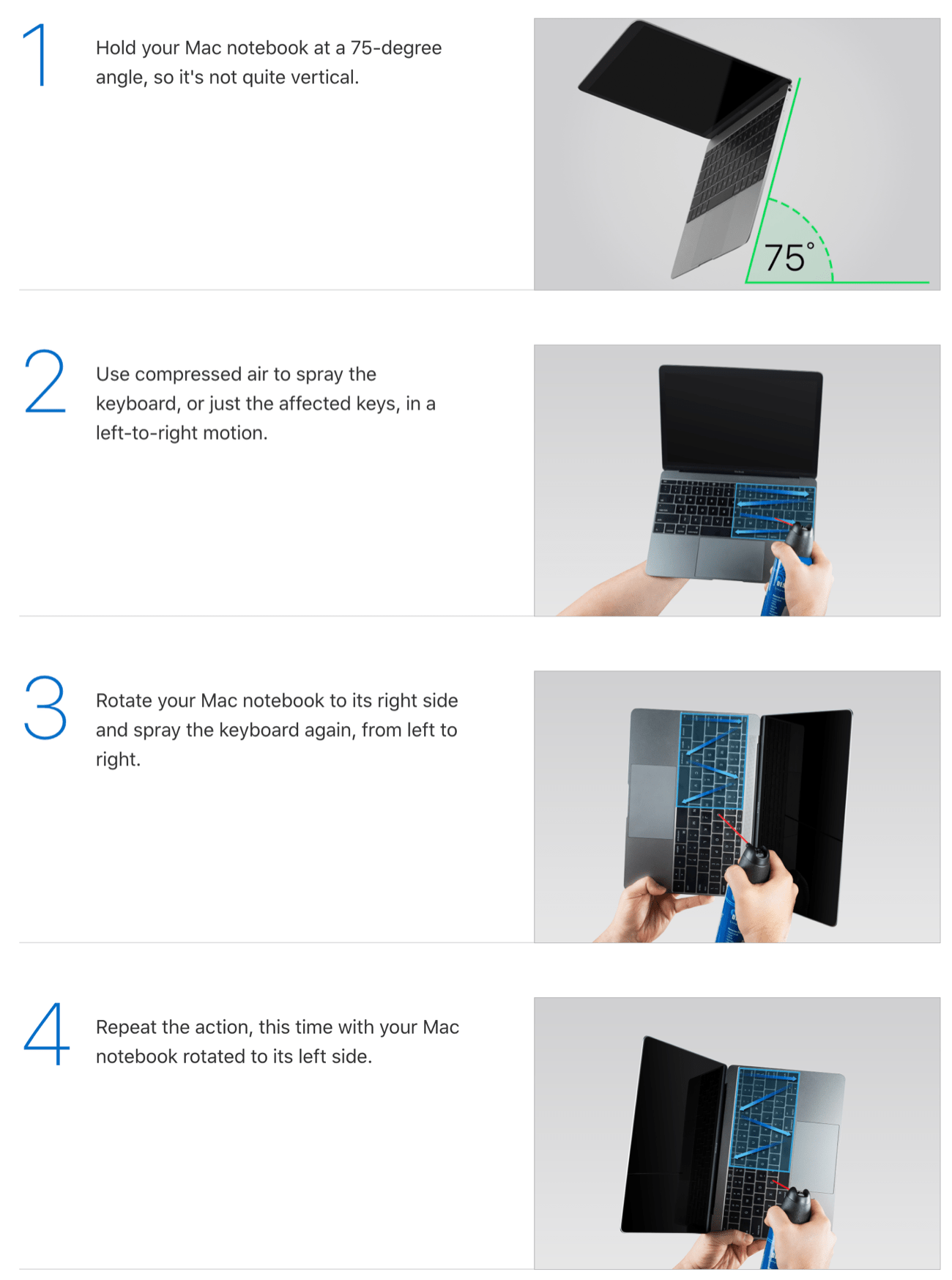

And yet, here we are: because the entire MacBook line does not yet have the new keyboard, Apple still hosts this support article that suggests cleaning your laptop’s keyboard with compressed air.

This is, needless to say, not normal, nor are keys failing on multiple computers for multiple generations of computers.

It’s that last bit — the multiple generations bit — that is of interest here. Apple first released its notorious butterfly keyboard in April 2015, and has only now replaced it in one model in November 2019. Over that time period the company has sold $99 billion worth of Macs, the majority of which have been laptops. This is truly the power of integration!

Or, to put it another way, the power — and downside — of monopoly. No, Apple does not have a monopoly in computers — how amazing would that be! — but the company does have a monopoly on macOS. It sells the only hardware that runs macOS, which is why millions of customers kept buying computers that, particularly in the last couple of years, were widely reported to be at risk of significant problems.

To be clear, Apple didn’t commit some sort of crime here. At the same time, it is hard to imagine the butterfly keyboard persisting for four-and-a-half years and counting if the company faced any sort of competition. Integration can produce a superior user experience, but once an integrated product faces no more competition it can result in something that is downright user-hostile.

NFC and Innovation

The second story comes from Germany. From The Verge :

Apple could be forced to allow rival payment services on iOS to compete with its own Apple Pay service in Germany after the country’s parliament voted in favor of the measures on Thursday, Zeit Online reports. The legislation came in the form of an amendment attached to an anti-money laundering bill, and it will need to pass through the country’s upper house before it can become law next year.

If these measures become law, then, in Germany, Apple could be forced to allow other companies to access its phone’s NFC chips, which it has historically tightly controlled access to. Zeit Online notes that the change could result in individual banks offering NFC payments through their own apps, rather than going through Apple’s service. Apple would reportedly be allowed to charge a fee for access to the NFC chip, but it wouldn’t get the reported 0.15 percent fee that it currently gets from each Apple Pay transaction.

There is absolutely a competition component to Apple Pay and Apple’s restriction on NFC. Because of its control of iPhones generally and their built-in NFC chips specifically, Apple is able to give Apple Pay a significant advantage relative to competing payment apps (which need to use clumsy QR codes); that means that Apple can leverage its position in smartphones into a strong position in payments.

What is worth highlighting though, particularly in the context of this article, is how integration can hamper innovation.

To back up, NFC stands for “Near-Field Communication”, which is a protocol for two electronic devices to communicate when they are within 1.5 inches (4 centimeters) of each other. There are three use cases for NFC chips on smartphones:

- Smart card emulation, where NFC devices act like payment cards; Apple Pay is an example of this, as are a host of other use cases, like transit tickets or smart keys.

- Reader/Writer, where one active NFC devices reads or writes to a passive NFC device, such as an NFC sticker that receives power from the magnetic field generated by the active device.

- Peer-to-peer, where two NFC devices exchange information on an ad-hoc basis.

In short, NFC makes it possible for two devices to communicate without any prior setup, making possible a range of use cases far greater than, say, Bluetooth…and yet the only NFC technology most of you have probably used is for payments. Why?

I think that Apple deserves a lot of the blame. While Android devices have had NFC chips since 2010, Apple only added them to iPhones with 2014’s iPhone, and it was limited to Apple Pay. Two years later Apple made it possible to read some NFC tags and use Apple Pay, and only two months ago made it possible to write NFC tags. No other payment solution can use Apple Pay, only five transit systems can use Apple Pay with an “Express Transit” mode, and only 11 more with time-of-purchase authentication.

The problem is that the NFC chip on iPhones is not open: it is integrated with iOS, and Apple is holding the reins tight. Given the company’s 0.15% skim of Apple Pay transactions, and previous attempts to charge 3rd parties for integrating into its ecosystem or building accessories , it’s fair to wonder how much financial considerations weigh in NFC’s sluggish roll-out. What seems unquestionable, though, is that innovation in the entire sector has been retarded because of Apple’s total control of NFC chips in iPhones.

App Store Control

The final story is from this weekend; from the Washington Post :

Apple removed all vaping-related apps from its App Store on Friday, siding with experts who call vaping “a public health crisis” and “a youth epidemic.” Some of the 181 vaping apps removed by Apple permit the user to control the temperature or other settings on vaping devices. Others offer users access to social networks or games. The App Store has never permitted the sale of vaping cartridges through apps.

“We’re constantly evaluating apps, and consulting the latest evidence to determine risks to users’ health and well-being,” Apple spokesman Fred Sainz said in a statement. Apple cited evidence from the Centers for Disease Control and Prevention and other groups that have linked vaping and e-cigarette usage to deaths and lung injuries.

It’s certainly tempting to cheer a decision like this, particularly given the health crisis that emerged around vaping this year, and the more widespread concerns about vaping being an on-ramp to tobacco use. Then again, given that the crisis seems centered on counterfeit cartridges, being able to connect to your smartphone could be a real benefit. Note this paragraph written by a medical marijuana user :

But there are also more sophisticated devices that have USB and even Bluetooth interfaces to enable the patient to control heat settings, display lights, and update the firmware. The Bluetooth devices are accompanied by apps on the iOS and Android mobile platforms which can allow the patient to measure and monitor their usage, and, as is the case with PAX to identify the medication loaded into the device, and to understand its contents, such as the overall cannabinoid profile, the terpene mix, and other components. It also allows a user to validate the authenticity of the medication as well as testing and batch results.

Those apps — and by extension, device functionality — are no longer available to iPhone users 1 — you can’t get this level of functionality in a browser — not because regulators ruled them illegal, or because Congress passed a law, but because a group of technology executives said so. And, what they said held sway because the App Store is integrated with the iPhone: Apple has a monopoly on what apps can or cannot be installed.

To be fair, you may not find a vape app ban problematic, no matter how concerning the principles at stake; how about the company banning an app that shows where protestors and police are clashing in Hong Kong , or an app that tracks drone strikes ? In both cases you can argue that Apple is simply abiding by the standards of the countries in which it operates, but the core reason why there is even a question about app removal is because of Apple’s control.

Apple’s approach to the App Store also raises both competition and innovation questions. With regards to the former Apple is leveraging its control of the App Store approval process into a tax on digital goods and/or an advantage for its own competing services; when it comes to the latter Apple’s restrictions on developer business models (which has improved a bit since that article, but is still lacking, particularly in terms of standalone trials and upgrades) has made it difficult for rich productivity apps in particular to emerge on iOS, and often that 30% is the line between being viable or not, particularly for licensed material.

Make no mistake, Apple’s close control of the App Store has had tremendous benefits, not simply for Apple and its bottom line, but also for developers, particularly by convincing customers scarred from the Windows malware debacle that it was safe to download and pay for apps. But that control — borne from innovation — has had significant costs as well.

Integration Versus Monopoly

This article is not a legal argument: in particular, I have used the term “monopoly” very loosely. What makes Apple so brilliant from a business perspective is that it has managed to, via hardware and software integration, earn monopoly profits in a way that would not normally be classified as a monopoly. 2 Still, it seems to me that while “integration” results in good outcomes, “monopoly” doesn’t: note the contrast between the advantages of integration I began with and the bad outcomes of late:

- The superior user experience of Apple’s integrated products somehow ended up with Apple delivering the user-hostile butterfly keyboard for four years and counting.

- Apple’s ability to leverage its user base to bring new products and features to market also meant that Apple could retard the development of NFC applications.

- Apple’s ability to drive superior profits from software-differentiated hardware is increasingly augmented by the attempt to extract rents on digital goods and/or give the company’s own services a competitive advantage.

The issue in all cases is a familiar one in technological markets, which often start in an ultra-competitive state, but quickly devolve into monopolies or duopolies as things like network effects and economies of scale takeover. We have seen similar progressions in operating systems, in search, in social networks, in digital advertising, in e-commerce — Apple pressing its advantages is hardly an exception!

The reason I find the Apple example particularly illustrative, though, is that it helps draw a line between the sort of healthy integration that is broadly beneficial, and monopoly rent-seeking that mostly goes to the dominant companies’ respective bottom lines.

Specifically, companies that create and or compete in new markets should be allowed to win, and reap the benefits of their innovation. I have no issue with Apple’s smartphone profits, or Apple Pay’s 0.15% or the App Store’s 30%.

What should be restricted, though, is leveraging a win in one area into dominance in another: that means Apple winning in smartphones should not mean it gets to own digital payments, and inventing the App Store does not mean it gets 30% of all digital goods (or be allowed to diminish the user experience of its competitors). Apple Pay and App Store payment processing should win because they are better — which can include being the default ! — not because they are a point of integration that has curdled into monopoly-type behavior that results in worse outcomes for everyone.

I wrote a follow-up to this article in this Daily Update .

- To be clear, existing apps will continue to work for now, including on new iPhones, but are not available to users who have not previously downloaded them; it’s also not clear if those apps can ever be updated to support new devices [ ↩ ]

- That noted, it seems likely the European Commission is going to classify Apple as a monopoly provider of iOS devices [ ↩ ]

文章版权归原作者所有。