Apple, Amazon, and Common Enemies

Apple, Amazon, and Common Enemies

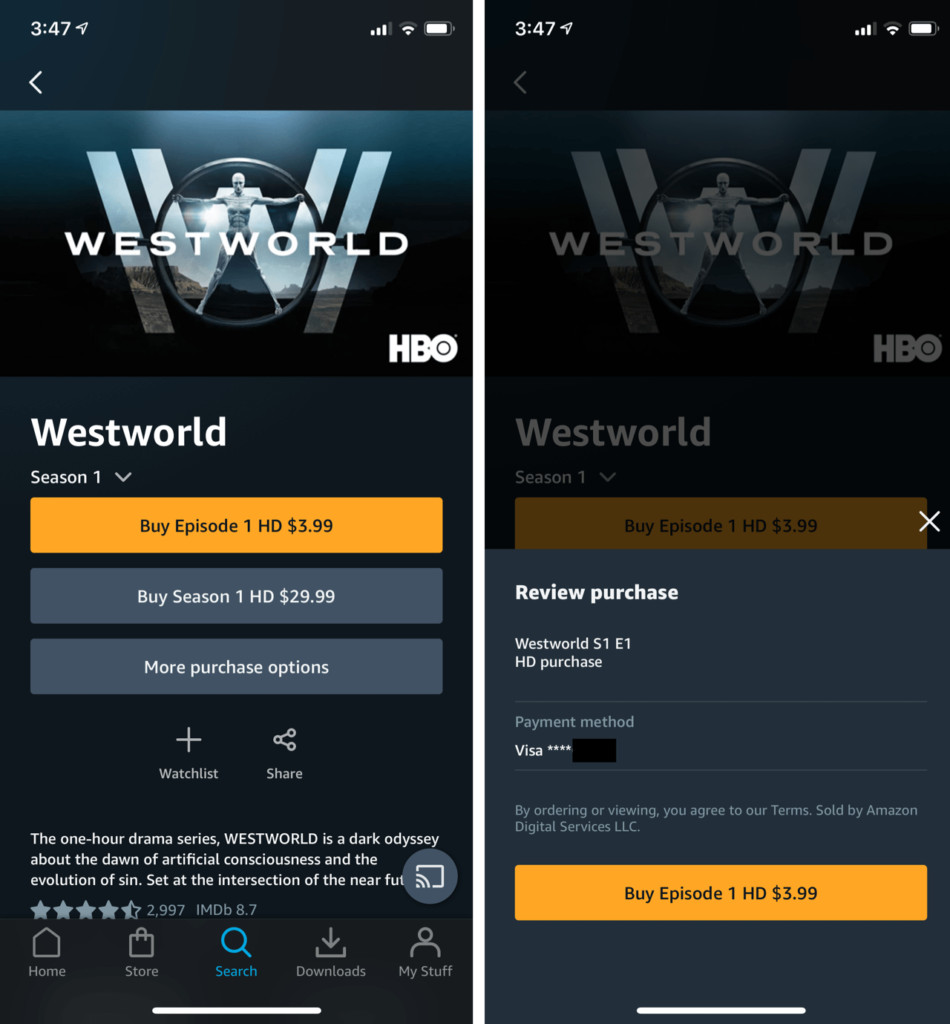

Last week, without fanfare, Amazon Prime Video apps on iOS made a subtle change to the experience of purchasing or renting TV Shows and videos:

That screen is not Apple’s in-app purchase screen, which was, by fiat, the only way to buy digital content on iOS devices. That meant that Apple received somewhere between 15% and 30% of ebook, music, video, etc. sales and subscriptions, even if Apple had nothing to do with their creation; another word for this is rent , thanks to Apple’s dominant position in portable devices, particularly the high end.

Apple was careful to say that this wasn’t a special deal to Amazon, noting in a statement:

Apple has an established program for premium subscription video entertainment providers to offer a variety of customer benefits — including integration with the Apple TV app, AirPlay 2 support, tvOS apps, universal search, Siri support and, where applicable, single or zero sign-on. On qualifying premium video entertainment apps such as Prime Video, Altice One and Canal+, customers have the option to buy or rent movies and TV shows using the payment method tied to their existing video subscription.

The Canal+ deal is likely tied to the premium channel’s decision to offer Apple TV set top boxes in lieu of its own back in 2018 ; Altice One made a similar deal earlier this year . Both, though, were about existing TV distributors (premium channels in the case of Canal+, and a traditional MVPD — multichannel video programming distributor — in the case of Altice One); Amazon Prime Video is an over-the-top streaming service with its own exclusive content, making this a much bigger deal than Apple’s statement might suggest.

Moreover, it’s not simply a big deal, it’s a fascinating one as well: you can make an argument it is better for Amazon, better for Apple, better for both, or neither — it just depends on your point of view.

Apple Versus Amazon

View 1: A Win for Amazon

Start with the narrowest point of view: the fact that Amazon can now sell and rent TV shows and movies on iOS devices from iPhones to iPads to Apple TV is a big win for Amazon. The reasoning is straightforward: 30% is a lot to pay to Apple, and now Amazon doesn’t need to.

It’s not a complete win, though: Amazon still can’t sell e-books in the Kindle app. In that case (as with Prime Video previously), Amazon leaves it up to customers to figure out that they have to browse to Amazon in Safari to make a purchase; Apple doesn’t allow apps like Kindle or Spotify to even suggest that customers can subscribe or purchase on the web.

View 2: A Quid Pro Quo

Of course Apple didn’t make this deal in a vacuum: the company’s statement clearly implied that the Amazon Prime Video app — which until a couple of years ago, didn’t even exist on Apple TV — integrated the full feature set of the Apple TV app (yes, it is confusing that the box, app, service, and subscription offering are all variants of the name Apple TV ).

The idea of the Apple TV app (which again, is different than the traditional Apple TV interface, and is available not just on the Apple TV box but also iPhone, iPad, and Mac) is to be the overarching interface for all TV viewing. Different video providers might have their own apps, but the content within those apps is surfaced in the same interface.

This is in certain respects a win for customers — instead of navigating multiple apps to find one show, they can simply go straight to the show they wish to watch — and definitely a win for Apple. They own the interaction point with the customer and are effectively commoditizing supply.

Indeed, this is where most of the analysis of this deal has settled: both Amazon and Apple are getting what they want, and customers are benefitting as well — a win-win-win.

View 3: A Win for Apple

I think, though, this analysis is incomplete, because it does not incorporate the broader video strategies of Apple and Amazon. The inclination of most people looking at the space is to assume that everyone is trying to be Netflix: earn a monthly subscription revenue for a library of shows, some number of which are created in-house.

The truth, though, is that Amazon has been making good money in video by doing what it does best: being a distributor; Variety reported back in 2018 that Amazon accounted for 55 percent of all direct-to-consumer video subscriptions. Moreover, Roku’s entire profit margin is predicated on the same business.

I have long argued that this was the best way to understand Apple TV+: Apple has, since the days of iTunes, understood the power and profit that comes from being a digital storefront; moreover, this approach fit squarely within the company’s Services narrative, which not only was about increasing Services revenue, but also increasing margin.

In other words, Apple TV+ was actually about Apple TV Channels: give customers a reason to use the Apple TV app, and then sell subscriptions to HBO, Showtime, Crunchyroll, etc. That is certainly the best way to understand Amazon Prime Video: there is not nearly enough content to seriously challenge Netflix, but there are shows worth watching, which makes the Amazon Fire TV boxes worth owning, and the Prime Video App worth using — and that means more subscriptions on which Amazon can take an ongoing percentage.

In this view, then, Apple is the clear winner: Amazon just made the Apple TV interface better, which means that Apple can sell that many more Apple TV Channels subscriptions — presumably at the expense of Amazon. I think Amazon was willing to make this tradeoff for a few reasons (that I first detailed yesterday ):

- Apple’s best customers — of which owning an Apple TV and using the Apple TV app is likely a good proxy — are unlikely to ever buy an Amazon Fire or use Prime Video as their primary interface. Therefore they aren’t really in the Amazon Channels addressable market anyways.

- Amazon now has much better access to Apple’s best customers, both in terms of pushing Amazon Prime Video and also selling and renting individuals shows and movies; moreover, it doesn’t have to share revenue with Apple. This is all additive.

The third reason, though, suggests what I think is the real quid pro quo.

View 4: Quid Pro Quo 2

This isn’t the first surprising development in the Amazon-Apple relationship in recent years. In December of 2018 the two companies made an announcement that I found far more shocking than this one; from Bloomberg :

Apple Inc. and Amazon.com Inc. announced their second partnership this month: the iPhone maker’s music-streaming service is coming to Amazon’s Echo devices in December. The move gets Apple Music onto the most-popular voice-controlled speakers, giving it distribution beyond Apple’s own devices. Subscribers will be able to control Apple Music with Amazon’s Alexa digital assistant, the first time Apple has opened up its music service to full voice control outside its own Siri technology. The decision pushes Apple’s music service into more living rooms at a time when its own internet-connected speaker, the HomePod, hasn’t sold as well as the competition. Given the breadth of Alexa-enabled speakers on the market, the move could also boost Apple’s own subscription numbers…

Apple definitely made a trade-off here, effectively sacrificing the HomePod’s biggest selling point for greater distribution for Apple Music. The real winner, though, was Amazon, which views Alexa as a critical investment and, by virtue of adding Apple Music, gained a meaningful differentiator relative to Google Home.

At the time I suspected that Prime Video on Apple TV was the quid pro quo; that seems even more certain now, particularly when you realize that Amazon has, in some respects, helped Apple compete against its own business.

The Coronavirus Impact

It is not enough, though, to only consider Apple and Amazon, particularly now, in the coronavirus crisis. There will certainly, both here and elsewhere, be plenty of missives about what will, and will not change because of the dramatic upheaval that is happening now; it is hard to say anything for certain, in part because of the uncertainty as to when the current crisis will pass.

At the same time, I think there is a general rule of thumb that will hold true: the coronavirus crisis will not so much foment drastic changes as it will accelerate trends that were already happening. Changes that might have taken 10 or 15 years, simply because of the stickiness of the status quo, may now happen in far less time.

It seems very plausible that cord-cutting will be a leading example. The number of households with MVPD subscriptions has been falling steadily, but the cable business has still been a profitable one for everyone involved, from distributors to networks. What happens, though, in a severe recession without live sports, the single best reason to subscribe to an MVPD in the first place?

I have previously made my case for the long run : MVPDs become de facto sports and live news bundles, in which a far smaller rump of customers pay similar prices for a smaller number of channels, almost all of which are devoted to live events and charge significant carriage fees. Meanwhile, almost all of the other jobs TV does , including drama, escapism, and filler, would migrate to streaming services that provided a better experience by virtue of eliminating time as a constraint .

It is the long run that is particulary interesting in the context of Apple and Amazon’s deal, because that inevitably bring Netflix into the picture. I wrote back in January 2016 about the company’s ladder strategy:

Netflix started by using content that was freely available (DVDs) to offer a benefit — no due dates and a massive selection — that was orthogonal to the established incumbent (Blockbuster). This built up Netflix’s user base, brand recognition, and pocketbook

Netflix then leveraged their user base and pocketbook to acquire streaming rights in the service of a model that was, again, orthogonal to incumbents (linear television networks). This expanded Netflix’s user base, transformed their brand, and continued to increase their buying power

With an increasingly high-profile brand, large user base, and ever deeper pockets, Netflix moved into original programming that was orthogonal to traditional programming buyers: creators had full control and a guarantee that they could create entire seasons at a time

Each of these intermediary steps was a necessary prerequisite to everything that followed, culminating in yesterday’s announcement: Netflix can credibly offer a service worth paying for in any country on Earth, thanks to all of the IP it itself owns. This is how a company accomplishes what, at the beginning, may seem impossible: a series of steps from here to there that build on each other. Moreover, it is not only an impressive accomplishment, it is also a powerful moat; whoever wishes to compete has to follow the same time-consuming process.

This actually underreported Netflix’s approach: the company has further shifted from buying its own shows to producing its own shows , which required far more cash up front (thus the massive negative cash flow in recent years), but with far more upside down the road.

Here’s the thing, though: I am not convinced that Netflix’s long-run optimal position is producing all of its own content. More importantly, I’m not sure this is the optimal position for content producers.

Disney Versus Netflix

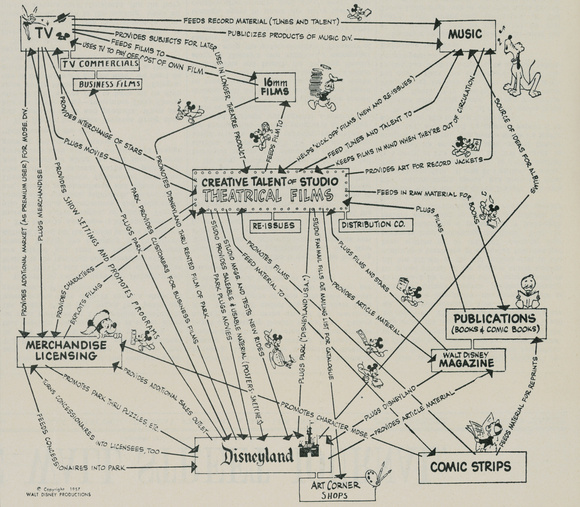

Disney is, as it often is, the exception that proves the rule. I explained last year in Disney and the Future of TV :

The best way to understand Disney+, which will cost only $7.99/month, starts with the name: this is a service that is not really about television, at least not directly, but rather about Disney itself. This famous chart created by Walt Disney himself remains as pertinent as ever:

This is the only appropriate context in which to think about Disney+. While obviously Disney+ will compete with Netflix for consumer attention, the goals of the two services are very different: for Netflix, streaming is its entire business, the sole driver of revenue and profit. Disney, meanwhile, obviously plans for Disney+ to be profitable — the company projects that the service will achieve profitability in 2024, and that includes transfer payments to Disney’s studios — but the larger project is Disney itself.

By controlling distribution of its content and going direct-to-consumer, Disney can deepen its already strong connections with customers in a way that benefits all parts of the business: movies can beget original content on Disney+ which begets new attractions at theme parks which begets merchandising opportunities which begets new movies, all building on each other like a cinematic universe in real life. Indeed, it is a testament to just how lucrative the traditional TV model is that it took so long for Disney to shift to this approach: it is a far better fit for their business in the long run than simply spreading content around to the highest bidder.

Implied in this analysis is the fact that, absent alternative monetization mechanisms like theme parks or merchandise, content is indeed best sold to the highest bidder. Content has extremely high fixed costs, and zero marginal costs; it follows, then, that the fiscally responsible content producers sell that content to as many outlets as possible, in order to maximize their leverage on those fixed costs. The only reason to do otherwise is if, like Disney, you have superior money-making mechanisms internally.

It follows, then, that endorsing Disney+ as a strategy is unique to Disney; nearly every other content company, without Disney’s ability to monetize content across properties and over time, ought to be pursuing maximum distribution for that content. And that means selling to Netflix: the streaming service has by far the largest customer base and, by implication, the greatest willingness to pay.

And yet, more and more content producers are seeking to launch their own streaming servies, from HBO Max to NBC Peacock and multiple examples in between. The economics of all of these offerings are, at best, questionable:

- First, these services are expensive in their own right. A company has to not only stand up its own streaming service, but also an entire infrastructure around payments and customer support.

- Second, the cost of content is considerable: Hollywood rules (often flouted, to be fair) dictate that streaming services have to pay fair market rates for their own content, which are pricey; that is before considering the cost of content produced elsewhere.

- Third, and most importantly, is the opportunity cost. Content on one’s own streaming service not only needs to be paid for, it also needs to not be sold to another streaming service, like Netflix.

I am very skeptical that these costs will be sustainable for most streaming services; my prediction is that most fold within 5 years, and that Netflix is there to pick up the pieces.

A Common Enemy

This is the most compelling lens with which to view Apple and Amazon’s recent partnerships. Both, given their desire to be a platform for over-the-top services, are on the same side when it comes to a potential Netflix-dominated future: neither want it to happen. Netflix dominating means that shows are sold directly to Netflix; channels are pointless. Apple and Amazon both, though, want channels to exist, if only so that they can sell subscriptions to them.

This, by extension, is a reason why Amazon might be willing to strengthen Apple’s platform, even as it competes with Amazon’s; it would also be a reason for a further quid pro quo — Apple offering access to its shows on Amazon’s devices. This remains to be seen. [ Editor: it appears this has already happened .]

Ultimately, though, I favor Netflix in the long run. Apple and Amazon’s strategy both entail replacing MVPDs with a streaming alternative that preserves the existing value chain; value chain transformation, though, inexorably alters the point of integration within the value chain . It seems safer to bet on the company that is predicated on a completely altered future than those hoping for mere substitutes.

文章版权归原作者所有。